The crucial role of sales and Operations Planning in a divestment program with two pharmaceutical companies.

The purpose of this text is to explain how taking a helicopter view on the Supply Chain before and after the divestment can avoid serious obstacles during the transfer project between two partners of a portfolio of products in multiple countries.

One upon a time a Company specialized in the acquisition of mature and niche products from Big Pharma, characterized by a high professionalism of collaborators, but with a very immature understanding of Supply Chain and lean concepts.

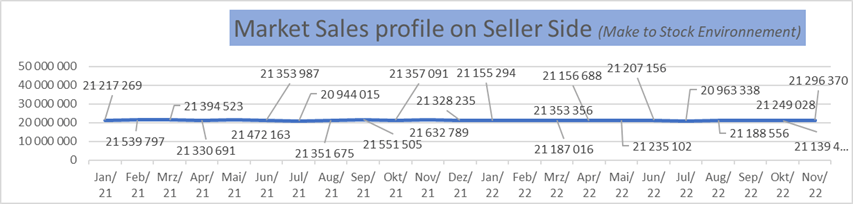

Before the acquisition, the Demand on the different markets was very stable although slowly declining.

Working with such a predictable and stable Demand in a Make to Stock model, was of course allowing the Seller, working with professional planners, to manage his Supply chain with extremely limited inventories on the different segments, and good Customer Service level. Obviously, their Supply Chain was globally control, using all the best Supply Chain Planning techniques.

Curiously, the transfer project had aborted a first time, a couple of months after the signature of the contract, for a lack of a Critical Materials needed to support the transfer stocks build-up.

Unfortunately, also, nobody could take any learnings from this first missed tentative, and the project was finally relaunched after 12 months, with the same objective to transfer a maximum of countries and SKU simultaneously.

The future finally demonstrated that the initial collapse of the project was not an accident, but the consequence of the ignorance on the buyer side, of the meaning and the benefits of the S&OP.

When acquiring the new products, the buyer introduced several Supply Chain “troublemaker” agents:

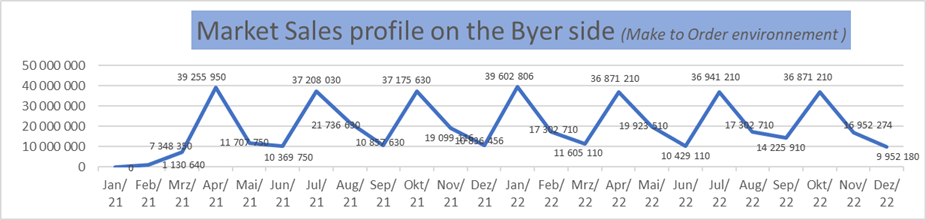

- The biggest Markets moved from a stable and controlled “Make to Stock” model to a more disordered “Make to Order” environment, introducing Ups and Downs in the Chain with obvious impacts on upstream requirements for Bulk.

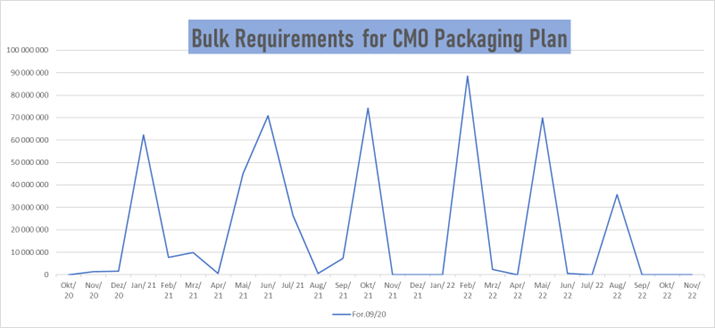

2. In a perfectly respectful desire to minimize Cost of Goods Sold, in the project came shortly later a Technology Transfer program for Finished Goods and Bulk, Working with a new Contract Manufacturer. When negotiating with the new CMO, a ridiculously small section in the contract, was indicating that the Packaging productions will be grouped by quarterly campaigns. Obviously, the buyer was ignoring the impact such a decision would have on the entire upstream Supply Chain.

From very stable Bulk requirements Plan for Packaging purposes, the Plan became suddenly a risky “roller coaster” ride with once again strong repercussion on the entire upstream Supply Chain.

3. Directed by the desire of becoming as soon as possible the real Market Authorization owner of the products, the buyer decided to plan Market Authorization Transfer and Stock Build-up for all xxx countries and yyy SKU, the same month.

4. Finally, guided by the fear of making mistakes generating potential Out of Stock situations, penalized by long Planning and Distribution Lead-times combined to the ignorance of Lean concepts, the Buyer decided to dramatically increase safety stock at all levels.

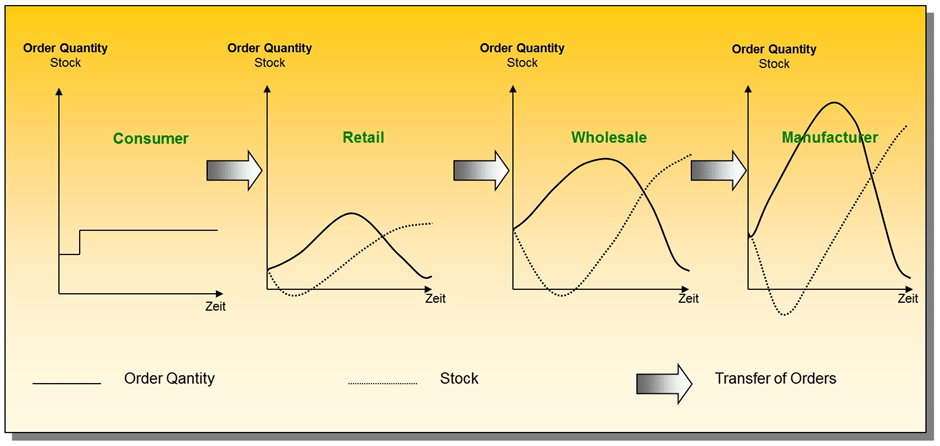

Like in a case Study for Supply Chain courses, the 4 new Supply Chain parameters introduced in the Supply Chain without any dialogue with the Seller, has generated a dramatic Bullwhip effects that the Partner could obviously not manage.

No Supply Chain in the world, whatever the industrial sector is involved, will never be able to manage successfully such a chaos.

It is then that the complaints, the lamentations, the frustrations on both sides were born.

It is then that the Solution came from the implementation of a new and robust Sales & Operations Planning process involving The Seller, the Buyer and the new CMO.

Only the S&OP, combined with the key Values of TRUST and TRANSPARENCY between the partners on the different Supply Chain segments, will guarantee that the transfer Plan will happen on TIME with full stakeholders and customers satisfaction.

What we did to save the project from unexpected delays was 1st to give full visibility on the E2EB Supply Chain figures (Demand & Supply Plans) to all actors, from API to Finished Goods.

From experience, TRANSPARENCY is always bringing TRUST with the partners.

2d, discussing with the CMO, we succeeded to break the obsolete concept of working with limited and rigid campaigns and smooth more properly the production through the year. The results of discussions are visible in the following diagram where we can clearly see a progressive flattening of the bulk demand curve.

3d, negotiating steps by steps with the Seller on Supply Capacities, playing with the reduction of unnecessary inventory buffers introduced in the Supply Chain by the Buyer, we succeeded to, propose to Top Level Management of both Companies a transfer Plan with a minimum of changes versus the initial Target.

After a couple of monthly S&OP runs and meetings, the new Supply Chain progressively became under control, which has lead to the most beautiful compliment I ever received from a Partner in my professional live:

(message I personally received fom Astra Zenaca project Manager at the end of the divestment project.)

Emmanuel de Ryckel

PS: Any similarity with Companies or Characters that have really existed is purely fictional.

Leave a comment